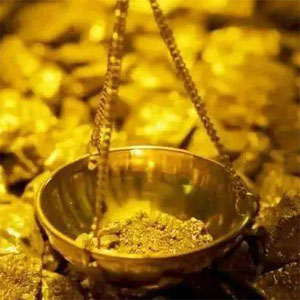

The first choice for contemporary people's asset allocation

- Globally, the total supply of physical gold is limited, and gold mining is very difficult. Physical gold has long-term effective purchasing power, so it can resist currency depreciation very well. Moreover, it is easy to deliver and has strong liquidity. It can not only help individuals avoid risks, but also make family assets grow steadily. The rarity of physical gold brings investment value. Any changes in the political situation will not affect the supply of gold, so gold will not depreciate like paper money that can be printed in large quantities. Whether it is a financial crisis or a war, most assets will have large-scale counterparty risks, but physical gold does not have this problem. When turmoil occurs, investors always flock to gold to hedge and preserve value.

-

Physical Gold

Physical gold, instant exchange, instant collection, no time limit, no country limit, no city limit.

Anti-inflation

Due to the unique properties of physical gold, any changes in the situation will not affect the supply of gold, so physical gold will not depreciate.

Powerful value preservation function

Physical gold has always been used as a tool to preserve value and can maintain purchasing power over a long period of time.

Hedging function

Whether it is a financial crisis or a war, most assets will incur large-scale counterparty risk, but physical gold does not have this problem.

Portable anonymous wealth

Physical gold itself is extremely valuable and portable, making it an excellent choice for transferring wealth and preserving value when turmoil occurs.

Hedging currency risk

There is a relatively high inverse correlation between gold prices and currencies, so holding some gold can hedge against the risks brought by currencies.